Click on e-Filing PIN Number Application on the left and then click on Form. Answer 1 of 5.

How To Create An Income Tax Calculator In Excel Youtube

Long answer - If caught by the LHDNs auditor youll face a penalty ranging from 80 to 300 of the taxable amount.

. The rate of tax for resident individuals for the assessment year 2020 are as follows. Calculations RM Rate TaxRM A. On the First 5000.

The tax rate for 20192020 sits between 0 30. But you can declare your employment income as RM 000 in this way you are not required to pay tax to Malaysia. RM9000 for individuals.

Click on Permohonan or Application depending on your chosen language. Yes you should submit your e-filing via the LHDN website. Simply put if he falls under the maximum income tax of 14 then Bryan would pay a.

For example if your total. Well be helping you all the way with a step-by-step guide for filing your income tax in Malaysia 2022 YA 2021. How to Declare Income.

There are however certain extra steps that freelancers. If youre not sure what counts as income that you have to declare for tax purposes weve elaborated more on this in a later sub-section of this guide How To File Income Tax In. How to Declare Income.

Arts and Culture Malaysia and entrance fees to tourists attractions incurred on or after 1st March 2020. Up to RM3000 for. For non-residents in Malaysia the.

Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. On the First 5000 Next 15000. Now its time to file your taxes and hopefully get a tax refund.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. The rental income commencement date starts on the first day the property is rented out whereas. Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year.

Inland Revenue Board of Malaysia Tax Information Record Management Division Tax. Overall the tax filing process will not be tremendously different between an employed individual and freelancers. The answer is Nope.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Hardcopy submission manually to Tax Information and Record Management Division IRBM. Thats a lot of money people.

The amount of income tax payable depends on Bryans tax bracket for 2018. Foreigners who qualify as tax-residents follow the same tax. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

How To File Your Taxes For The First Time

Individual Income Tax In Malaysia For Expatriates

Provision For Income Tax Definition Formula Calculation Examples

Guide To Using Lhdn E Filing To File Your Income Tax

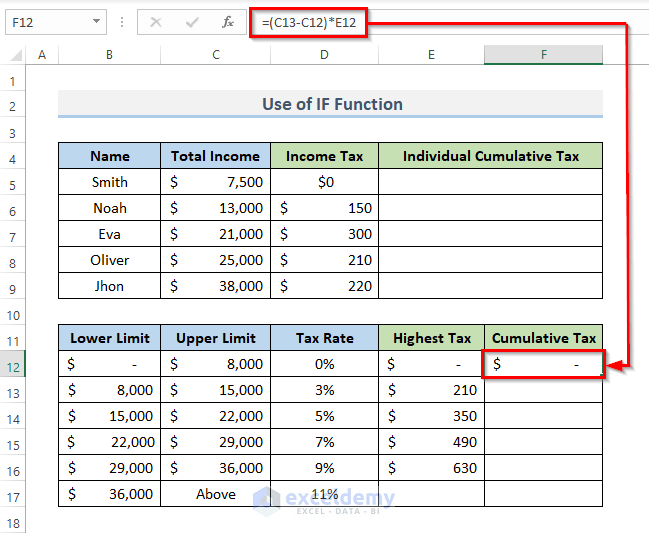

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

Provision For Income Tax Definition Formula Calculation Examples

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Computation Of Income Tax Format In Excel For Companies Exceldemy

How To Calculate Income Tax In Excel

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

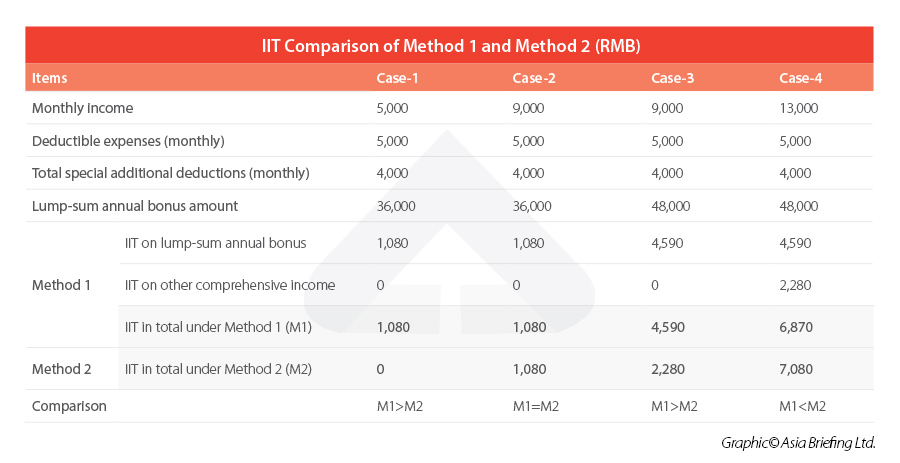

China Annual One Off Bonus What Is The Income Tax Policy Change

How To Calculate Income Tax In Excel

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)